Who We Are

EXPERT ADVICE ON PUBLIC DEBT FOR DEVELOPING COUNTRIES

The Debt Management Facility is a multi-donor trust fund whose objective is to strengthen debt management to reduce debt-related vulnerabilities and improve debt transparency in more than 80 countries.

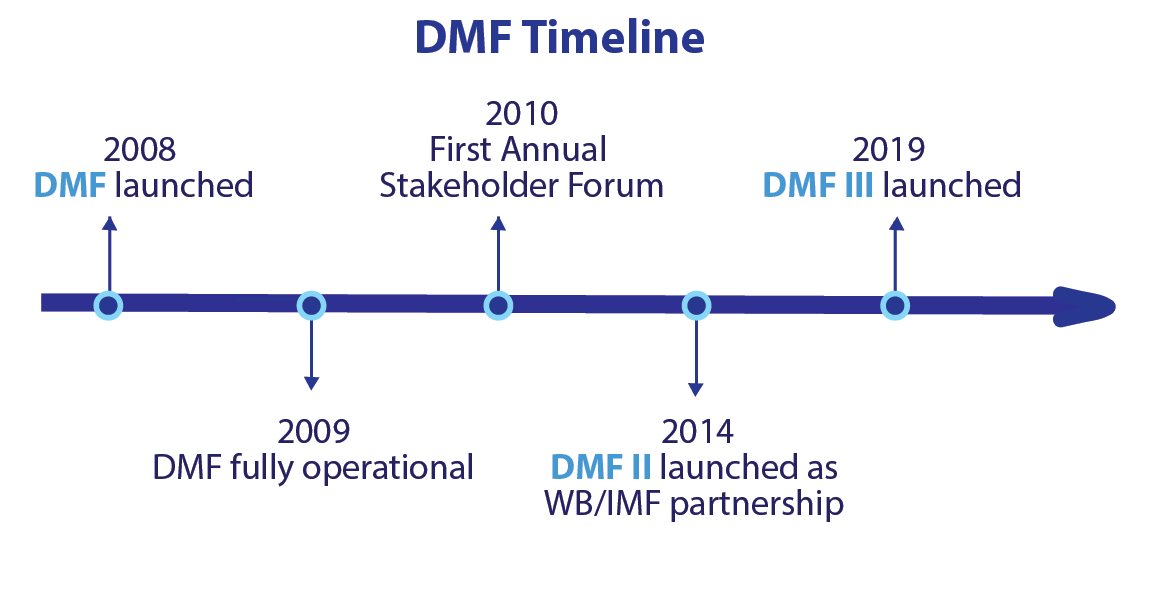

The Debt Management Facility (DMF) for Low-Income Countries (LICs) was launched in November 2008 by the World Bank as a multi-donor trust fund that supports the scaling up and accelerated implementation of the World Bank Group's debt management work program in low-income countries. The program has the specific objective of strengthening debt management capacity and institutions through a number of tools that help countries assess and plan their debt.

In 2014, the World Bank Group launched a second round of the trust fund (DMF II) that formalized a partnership with the International Monetary Fund. Experts from both institutions would now execute trainings and technical assistance for DMF-eligible countries seeking to strengthen and professionalize their debt management. The list of topics covered by the trust fund was expanded to cover emerging issues, such as domestic debt market development and the issuance of debt on international markets.

In 2014, the World Bank Group launched a second round of the trust fund (DMF II) that formalized a partnership with the International Monetary Fund. Experts from both institutions would now execute trainings and technical assistance for DMF-eligible countries seeking to strengthen and professionalize their debt management. The list of topics covered by the trust fund was expanded to cover emerging issues, such as domestic debt market development and the issuance of debt on international markets.

The third phase of the Debt Management Facility (DMF III) was launched at the 2019 Bank-Fund Spring meetings, scaling up the work of the DMF, and continuing to adapt DMF offerings to address evolving country needs. DMF III builds on a decade of track experience and results and looks to the future in supporting debt management capacity building in a changing debt landscape for low and middle income developing countries. DMF III introduces capacity building in areas that support boosting debt transparency such as in areas of debt reporting and monitoring, and debt-related contingent liabilities and other relevant fiscal risks; and enhances Technical Assistance related to debt management institutions. In addition to introducing new trainings in these areas, DMF III also seeks to expand outreach activities and pilot innovative peer-to-peer learning initiatives.

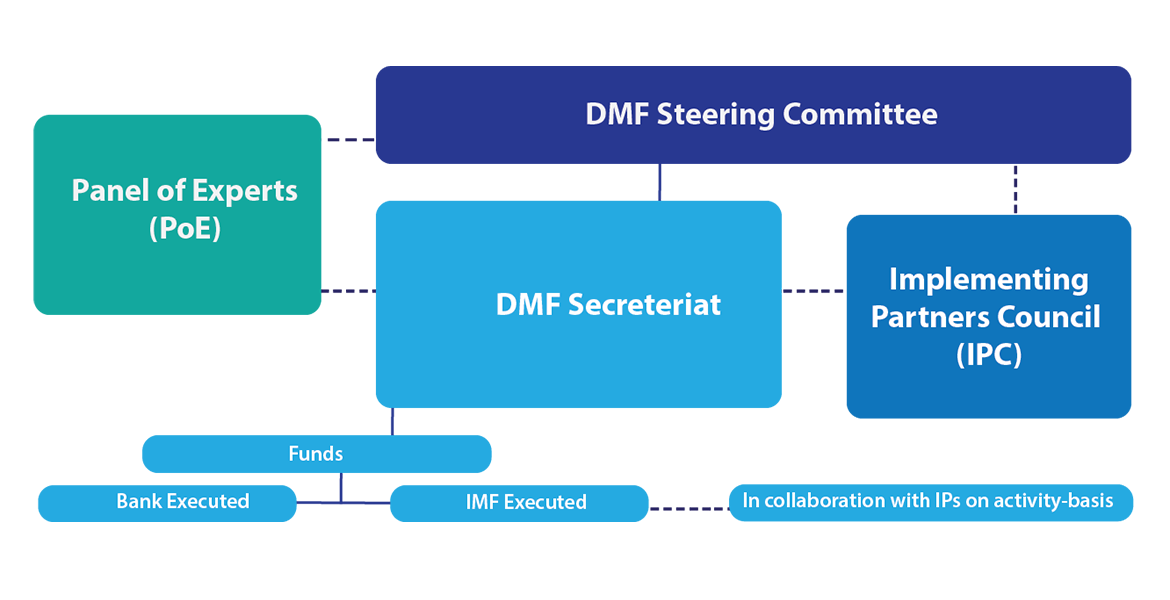

DMF: A FOUR-TIER GOVERNANCE STRUCTURE

A Steering Committee (SC): provides overall strategic guidance for the DMF, sets policies, endorses the annual Operational Strategy, and reviews DMF performance. The SC is jointly chaired by the World Bank and the IMF. The committee is composed of the co-chairs and one representative of each of the donors that meet the funding eligibility requirements.

The Secretariat: headed by a Program Manager, is responsible for: (i) coordinating the activities with the donors, the IMF, and the Implementing Partners, including mission planning; (ii) providing administrative support to the Steering Committee; (iii) submitting the annual Operational Strategy and all DMF-related reports; and (iv) managing the DMF website. It is located in the Macroeconomics, Trade and Investment Global Practice of the World Bank..

A Panel of Experts: provides advice to the Steering Committee on program relevance and quality. The panel meets several times during the year, and their observations on several materials, such as the draft DMF Annual Reports and the draft annual Operational Strategy, are systematically requested by the Secretariat.

The Implementing Partners Council (IPC): provides a coordinating mechanism among the Secretariat, the Bank, IMF, IPs and other debt management TA providers to share progress made towards the DMF III’s work program. It is chaired by the Secretariat and discusses lessons learned from technical-assistance and training engagements in DMF-eligible countries and the pipeline of country engagements. It focuses on sharing results and sound practices. The IPC was introduced under DMF III and supercedes the Implementation Coordination Group.